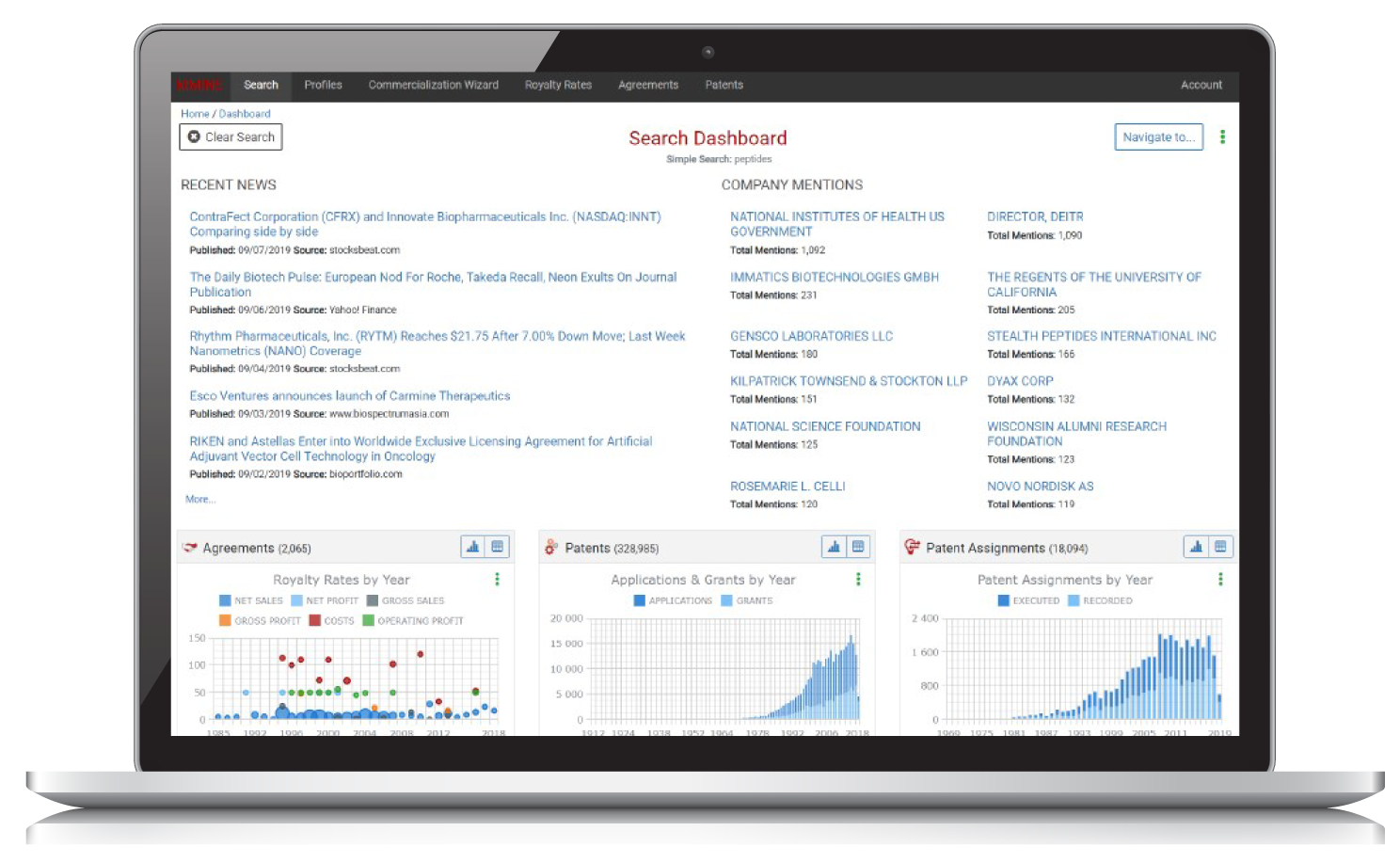

Innovative Approach

IP Strategy & Valuation

The global intellectual property landscape is ever-evolving. Law firms, corporations, consultants, governments, and universities rely on intelligence from ktMINE’s applications and data services to protect and support IP valuation and strategy business decisions.