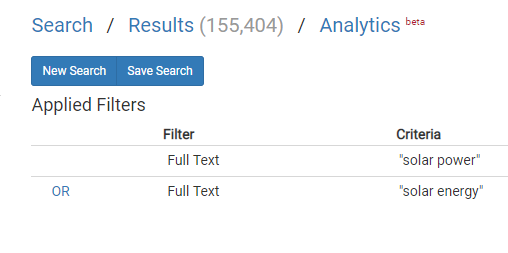

Over the past few years, China has become the leading global power in solar energy. This is unsurprising given that the government has formally thrown itself behind the endeavor to grow both domestic solar consumption and exports of Chinese manufactured solar cells. But will the trend continue? ktMINE recently conducted an analysis of solar industry trends to find out.

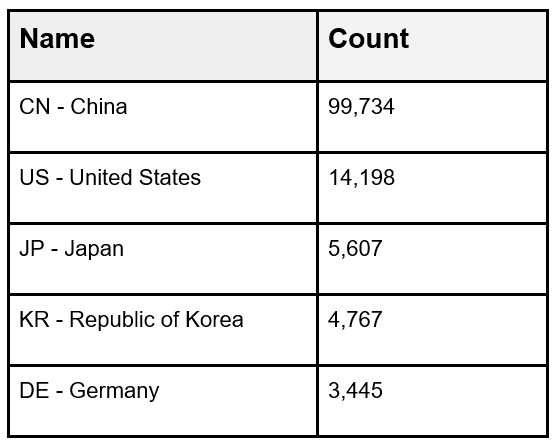

Running the below search within the ktMINE IP Platform and grouping by document country reveals that China is indeed in the lead with respect to the raw number of patent documents in solar power. With over ninety-nine thousand patents documents, China has seven times as many as the next closest contender, the US.

Source: ktMINE IP Platform contains millions of patent documents

Source: ktMINE IP Platform contains millions of patent documents

Restricting to the past five years causes Germany to drop out of the top five and increases China’s lead over the US to greater than 20 times as many patent documents in this area, which appears to be an accelerating trend. If we look at just 2016 and 2017, China dwarfs the US by almost forty times.

Possible Reasons for the Rise of Solar Power Technology in China

There are a number of reasons that China might continue on an accelerating path of solar patenting activity. As mentioned, the government has thrown itself behind the goal of increasing solar adoption. Solar is likely seen by the government as an effective way to prevent the domestic pollution problem from getting further out of hand and a way to reduce China’s contribution to the rise of global temperatures. Most of China’s electricity generation comes from coal, which creates more pollution than other energy sources like natural gas. This makes large-scale adoption of solar power more likely.

However, China has recently pulled back on subsidizing the solar power industry, and the US has placed tariffs on imported solar panels. The economic effects of these actions could be partly offset by the fact that the EU has recently removed its own anti-dumping measures against China. To find out if the economic effects of the current trade wars will ultimately slow inventive activity in the solar energy sector keep an eye on patent activity in the next few years. It’s too soon to see this in the patent data, which can lag by around eighteen months. Additionally, huge R&D initiatives are often several years in the making, and it could be difficult to change course on a dime, which may cause inventive activity to trail further behind the trend. If the trade wars persist, we might begin to see changes in investment reflected in patent data over time.

How Does IP Strategy for Solar Differ in China?

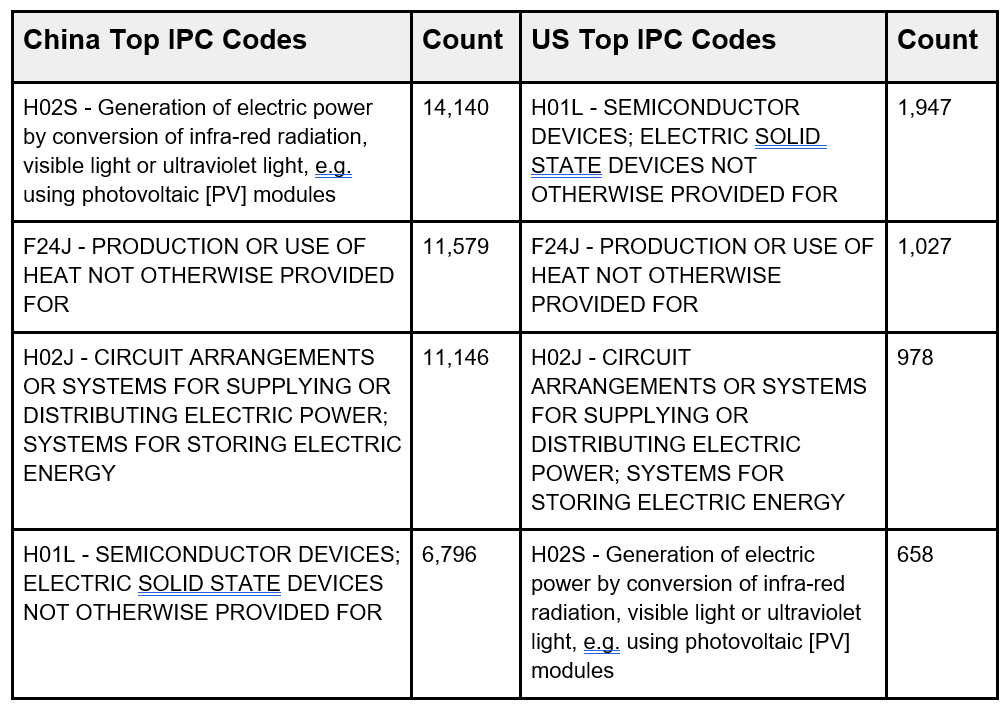

Looking at the past five years of Chinese and US patent documents we can see that the top four IPC codes are very similar.

Source: ktMINE IP Platform contains millions of patents & assignments

A parallel can be drawn to the recent ZTE operations shut down. ZTE, one of China’s leading telecommunications equipment manufacturers, relied heavily on Qualcomm chips, which are also semiconductor devices, and was forced to shut down almost all of its operations this April when the US government banned domestic companies from doing business with them. The Chinese government has acknowledged a national need to strengthen chip manufacturing technology. However, in absolute numbers, Chinese patent activity is still six times greater than the US in the H01L category within our solar power search criteria.

Note that the first- and fourth-ranked IPC codes for China and the US are switched. China’s top IPC code is H02S, “Generation of electric power by conversion of infrared radiation, visible light or ultraviolet light, e.g. using photovoltaic [PV] modules,” while that of the US is H01L, “Semiconductor devices; electric solid state devices not otherwise provided for.” This trend could mean that companies in the Chinese market are favoring translational research rather than basic research. Many of the inventions in the H02S category make use of semiconductor devices but do not constitute semiconductor devices themselves.

Where Does the Road Lead for Solar Technology in China?

According to a Bloomberg article published this month, Chinese solar manufacturers are still increasing production capacity despite a recent decline in prices for solar panels around the world. The article speculates that even if the market on the whole contracts, Chinese firms can extract a larger market share. Domestic demand should also continue to drive solar business in China. China has the largest population in the world and is the fourth largest country in the world by area. Chances are good that China will maintain a big influence in the solar market for the foreseeable future.

Update: It was previously stated that patent activity lagged by 3 months. This post has been updated as of 10/4/18 to correct that statement.