In part one, we looked at overall application filings and grants for U.S. patents to observe how the volumes might have been impacted by recent events. Let’s switch gears a bit and look at the top filers of U.S. applications and grants.

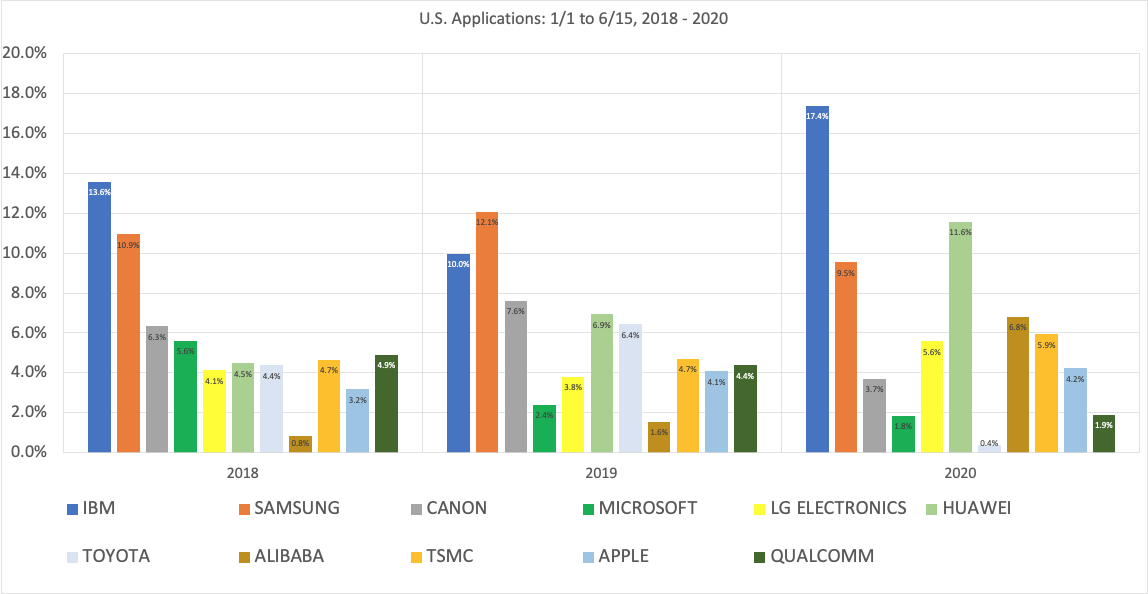

Applications:

In chart 1, we see IBM, Samsung, Canon, and Microsoft leading the pack in filings for 2018 and 2019, perhaps to no one’s surprise. For 2020, it appears that IBM and Samsung continue to maintain their high-volume filing strategies. For 2018, IBM filed 13.6% of the applications for those entities in the top 20, followed by 10% in 2019 before climbing to 17.4% in 2020.

For Huawei, Alibaba, and TSMC, there is a noticeable surge in the volumes filed by these companies. This can be an indication that they are looking to exploit market-driven opportunities.

The declines are interesting as well and may be more telling, with Microsoft, Qualcomm, and especially Toyota dramatically falling off of their usual pace. It is difficult to discern whether these reductions are cost control measures in reaction to the current economic environment or if they are because of sector-specific market trends.

Chart 1: Top 20 filers of U.S. Applications, by percent

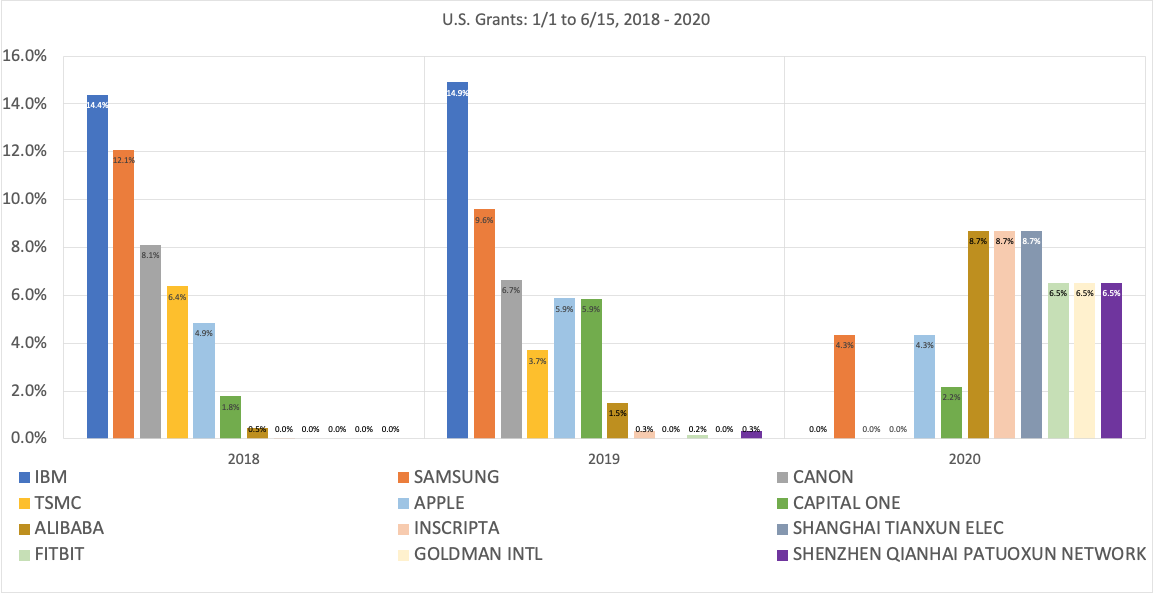

Grants:

U.S. grants are insightful as well. As seen in chart one, grants for U.S. patents have fallen off dramatically in 2020. In this chart, we notice Samsung as the only top player to maintain its top grant activity through 2020.

Chart 2: Top 20 filers of U.S. Grants, by percent

We might guess that the USPTO is emphasizing its efforts on technologies related to the mitigation of COVID, but with Samsung still featured prominently, this might not be the case.

We might guess that the USPTO is emphasizing its efforts on technologies related to the mitigation of COVID, but with Samsung still featured prominently, this might not be the case.

A more plausible explanation might be related to how different companies react to market stressors: Perhaps IBM, Canon, Microsoft, and others have chosen to withhold patent prosecution resources in anticipation of future hardships, with an eye towards keeping their options open.

Companies like Alibaba (online retail), Inscripta (biotechnology), Shanghai Tianxun (electronics), and others may be benefitting from a timing quirk that had seen their applications prosecuted and granted just as the Coronavirus was setting in and prior to any processing changes at the USPTO. Further, they may also have less exposure to market risk and so may be able to exploit any presented opportunities.

In part three, we’ll wrap up by taking a look at the top filing industries and see how they have performed during the past few years.