On June 15, 2018, AT&T completed an $85 billion merger deal with mass media company Time Warner Inc. While the deal was a success for AT&T and Time Warner, it was not received favorably by all. The merger faced opposition including litigation from the U.S. Department of Justice (DOJ) and criticism from politicians on both sides of the aisle. The DOJ filed their lawsuit against AT&T and Time Warner in November of 2017. However, AT&T won and proceeded with the merger. The DOJ appealed the suit on July 12, 2018.

The Backstory and Implications

The approved merger allows AT&T to combine its massive distribution network, which includes cable, wireless, and broadband services, with Time Warner’s media assets and entertainment content. The merger combines the second largest phone provider, third largest broadband provider, and second largest cable provider with the conglomerate that owns the rights to the NBA and MLB playoffs. By acquiring Time Warner, AT&T now has ownership over content and assets such as CNN, HBO, and TBS. A combined IP Profile of AT&T and Time Warner within the ktMINE IP Platform yields over 1500 related subsidiaries between the two companies. According to a release from AT&T, it believes the merger will help it to compete with streaming services like Netflix and Hulu; both of which have original content that does not have to be licensed out.

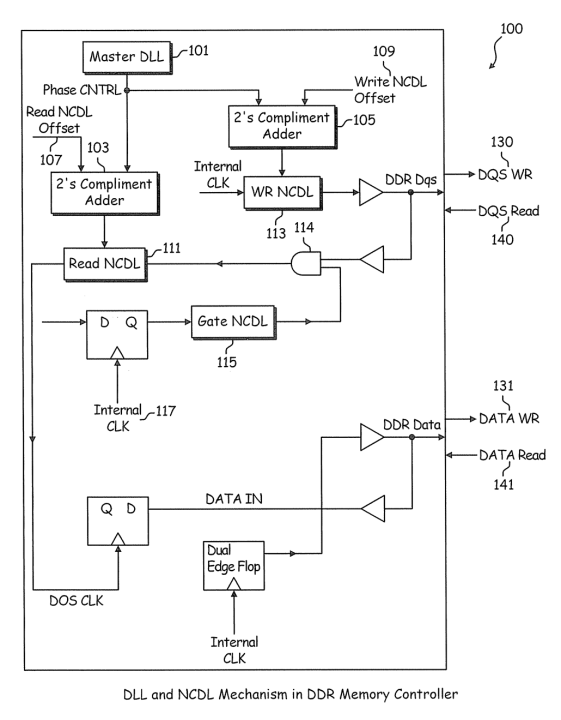

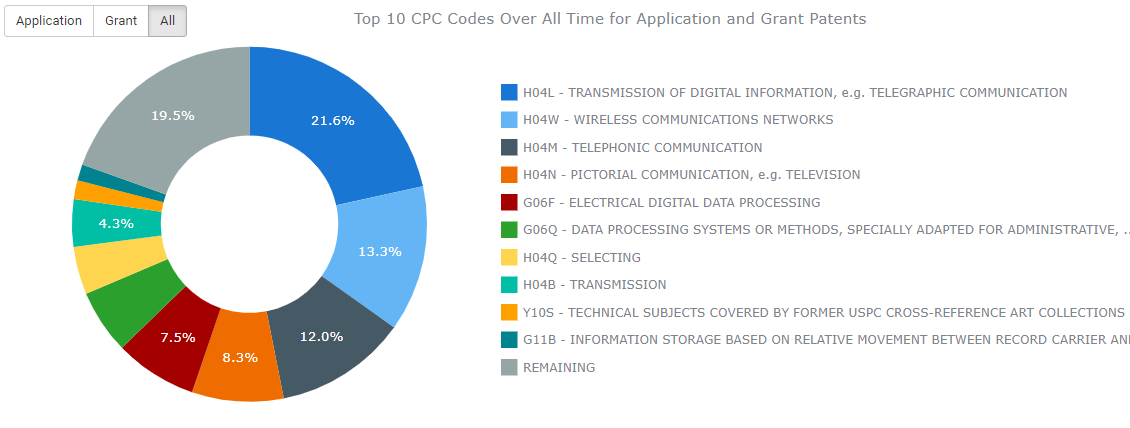

Combined Patent Portfolio: AT&T – Time Warner

Source: ktMINE IP Platform contains millions of IP Profiles for companies across the globe.

The approval of this merger could create a precedent clearing the path for major mergers, such as the proposed Disney/Fox merger or a possible CBS/Viacom merger. Those opposed to the merger believe that AT&T now has the ability to raise its prices on consumers as well as provide Time Warner content exclusively to AT&T customers. An additional possibility is that AT&T will raise the price on Time Warner content for rival companies. Other opposers also say the merger creates a monopoly and concentrates power into too few hands.

The Court of Public Opinion

The merger even reached the political world with opposition on both sides of the aisle. Senator Bernie Sanders took to social media and had this to say:

Source: Bernie Sanders Twitter

“This merger represents a gross concentration of power that runs counter to the public good. At a time when our telecommunications and media industries are already too concentrated, we should be focused on opening those markets to more competition, not less.”

When the merger was first announced, then-presidential candidate Donald Trump was quoted as saying, “As an example of the power structure I’m fighting, AT&T is buying Time Warner and thus CNN, a deal we will not approve in my administration because it’s too much concentration of power in the hands of too few.”

The Case and the Decision

On November 20 the DOJ officially filed suit against the proposed merger citing antitrust laws. The DOJ’s formal complaint cites section seven of the Clayton Act which prohibits acquiring stocks or assets where “the effect of such acquisition may be substantially to lessen competition, or to tend to create a monopoly.”

In the end, AT&T won the trial and was able to proceed with the merger. An official post-trial brief of the defendants (AT&T and Time Warner) stated that,

“The government came nowhere close to proving that this merger violates Section 7 of the Clayton Act…In fact, far from proving a likelihood of substantial harm to competition, the government’s own evidence proved the opposite. As to its price-increase theory, the government itself conceded that the merger would cause prices to go down for millions of AT&T customers nationwide… The government, in short, gave the Court no basis for finding that this merger is likely to reduce competition at all, much less substantially.”

Had the DOJ won the trial AT&T would have had to pay Time Warner a reverse breakup fee of $500 million dollars, only 0.6% of the $85 billion dollar merger. The final decision was given on June 12, 2018, and the DOJ was given until June 21st to appeal, initially deciding against it.

However, On July 12, 2018, the DOJ filed a notice of appeal against the merger. Upon announcement of the appeal the AT&T stock dropped 0.9%. While the DOJ has not made comment as of yet, AT&T’s chief counsel David McAtee released a statement saying,

“The Court’s decision could hardly have been more thorough, fact-based, and well-reasoned. While the losing party in litigation always has the right to appeal if it wishes, we are surprised that the DOJ has chosen to do so under these circumstances. We are ready to defend the court’s decision at the D.C. Circuit Court of Appeals.”

The ruling of the appeal could set precedent against major corporate vertical mergers should the DOJ win.