On September 12, the online family tree and DNA analytics company Ancestry announced its plans to delay its forthcoming IPO. Earlier this year in a civil suit (1:2015-cv-00355), the company was compelled to pay a $12.5 million settlement to DNA Genotek. The suit was over a patent infringement claim related to its saliva DNA testing kits. Even with this news, Ancestry, who operates the website Ancestry.com among others, reportedly expects to make $1 billion in revenue this year. That’s a growth rate of 30% from 2016.

From all indications, consumer demand for genealogical research products is not slowing down. In particular, at-home DNA testing kits have become ubiquitous. Ancestry’s at-home kit product is the AncestryDNA Genetic Testing Kit. Other companies offer their own direct-to-consumer DNA testing kits aimed at determining consumers’ DNA ancestry and genetic health. Major competitors of Ancestry include:

- National Geographic’s Geno 2.0 Next Generation Kit

- 23andMe’s DNA Ancestry service

- MyHeritage’s DNA kit

Patent Infringement Litigation Activity

Although there are a limited number of providers for these testing kits, there is no shortage of litigation in the DNA ancestry industry:

| Plaintiff | Defendant | Case Number | Patent | Outcome |

| DNA Genotek Inc | Ancestry.com DNA LLC | 1:2015-cv-00355 | US8221381B2 Container system for releasably storing a substance | Ruled in favor of DNA Genotek, Ancestry ordered to pay out $12.5M for patent infringement |

| Genetic Technologies Limited | Laboratory Corporation of America Holdings, Laboratory Corporation of America, 23andMe Inc | 1:2012-cv-0173 | US7615342B2 ACTN3 genotype screen for athletic performance | Case dismissed with prejudice for failure to state a claim |

| Promega Corporation, Max-Planck-Gesellschaft zur Forderung der Wissenschaften EV | Life Technologies Corporation | 3:2010-cv-00281 | USRE37984E Process for analyzing length polymorphisms in DNA regions | Case dismissed with prejudice for failure to state a claim |

DNA Genotek’s case against Ancestry is the most recent court case relating to DNA testing kits. In February, the Supreme Court presided over the patent infringement litigation filed by Promega Corp. against Life Technologies Corp. That case involved the sale of short tandem repeat (STR) loci testing kits. STRs are used widely in forensic analysis to distinguish one sample of DNA from another and to determine familial relatedness between individuals. According to Promega, LifeTech’s sale of a single component of their STR loci testing kit in Great Britain infringed upon a 2006 cross-license between the two parties. The Supreme Court, however, ruled that the sale of a single component of a patented invention in a foreign market did not constitute patent infringement.

23andMe was a defendant in a patent infringement lawsuit filed by Genetic Technologies Limited in 2012. In that case, 23andMe, Laboratory Corporation of America, and LabCorp Holdings were accused of infringing on a patent related to the screening of the ACTN3 genotype for athletic performance. The case was dismissed because the “prediction” of athletic ability, a claim asserted by the plaintiff, was not within the scope of the patent.

Market Demand of DNA Testing Rises

The 2013 US Supreme Court case of Association for Molecular Pathology v. Myriad Genetics established that DNA cannot be patented. Methods and tools for analyzing DNA, however, are definitively patentable. DNA ancestry testing relies on the analysis of DNA, particularly on genetic similarities between self-identified ethnic groups, to determine the likelihood of affinity between an individual and a reference population. Most commonly, sections of Y chromosomes, mitochondrial DNA, single nucleotide polymorphisms (SNPs) are examined for variations. This can then be used to predict the ancestral heritage of an individual.

While debate on the accuracy of such genetic tests exists, consumers still spend upwards of $100 per test kit to learn more about their DNA ancestry. Services like 23andMe have been cleared by the FDA to sell DNA tests for disease risks, in addition to genetic ancestry reports. Recent editorials from the New York Times and Washington Post illustrate the reach of these types of home testing kits, giving credence to their wide appeal among consumers.

Patent Landscape of DNA Ancestry

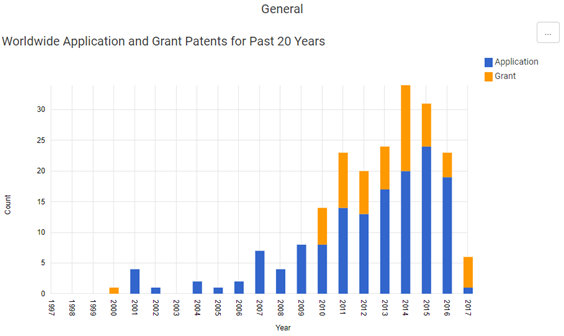

Patents for DNA ancestry testing rose sharply in the last 8 years, no doubt due to advancements in technology related to DNA sampling and analysis:

Source: ktMINE Patents App search of Full Text—“DNA Ancestry” or “DNA Genealogy”

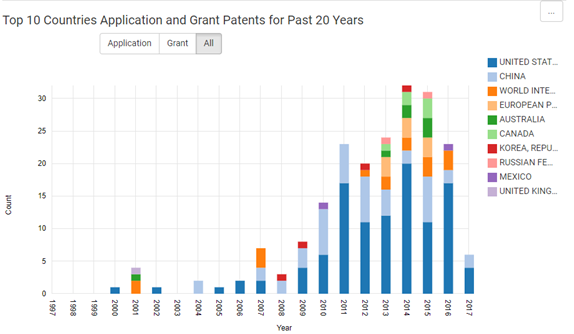

Applications for patents in the field began in 2000 with Patent US6774831A- Partitioning of Polymorphic DNAs. Patent grants and applications reached their zenith in 2014 and have trailed off since. 2017 will likely see 20 or fewer patents for technologies in the DNA ancestry industry. The United States holds the majority of patents filed, followed by the China and the World Intellectual Property Office (WIPO).

Source: ktMINE Patents App search of Full Text—“DNA Ancestry” or “DNA Genealogy”

A sample of patents filed in 2017 include:

- US2017242957A1- Discovering population structure from patterns of identity-by-descent

- EP3207482A1- Haplotype phasing models

- EP3207483A1- Ancestral human genomes

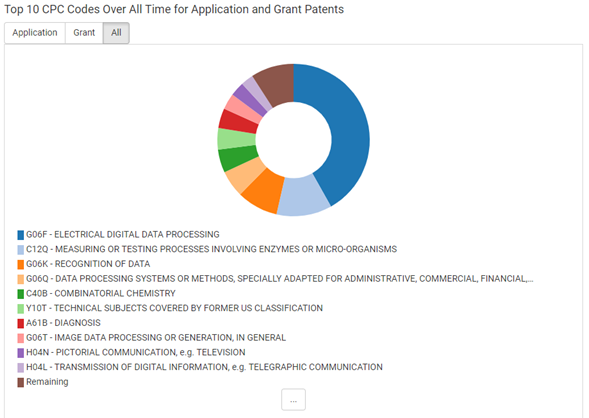

Common CPC codes for DNA genealogy patents relate to digital data processing, testing involving enzymes or microorganisms, and combinatorial chemistry:

Source: ktMINE Patents App search of Full Text—“DNA Ancestry” or “DNA Genealogy”

Highly Competitive and Litigious Markets Bring Risk

Even though there are a limited number of patents in the DNA ancestry industry, it appears owners place a high value on existing patents, given the amount of litigation surrounding them. These infringement claims may discourage other companies from entering into the DNA ancestry testing industry. This may be why there are so few companies provide DNA ancestry testing services, even though sales of testing kits continue to climb.

When Ancestry goes public later this year, will investors be willing to risk potential patent infringement lawsuits for increased company revenue?