With TikTok, Microsoft, WeChat, Twitter, and other social networks in the news recently, we thought we would take a look at some statistics related to IP to see if anything stood out.

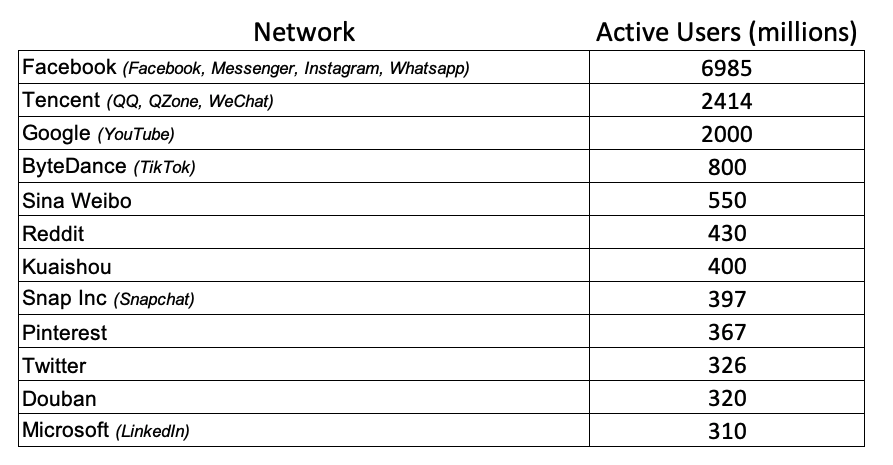

In a long list of social networks, there have been new offerings, acquisitions, and IPOs that have littered the past 20 years. By reported active users, Facebook has established a clear lead by using multiple acquisitions and new product developments (including Facebook Messenger, Instagram, and WhatsApp). With offerings like QQ, Qzone, and WeChat, Tencent is a very strong number two. Google also sports a strong presence with YouTube.

Social Networking Active Users

Source: Statistica

After the top three, however, things become more interesting. Many in the above list are established players that have distinct audience segments and, considering their tenures, it appears that each has settled into their own lane.

Tik Tok is a clear exception: It is one of the newest social network offerings, and despite its start in late 2016, it has broken out from the pack with active users approaching 1 billion.

On the other hand, Microsoft, with its LinkedIn network is at the bottom of the list. LinkedIn dates back to the early 2000s and has a business-oriented network that may not easily extend beyond professionals into broader and less formal segments.

Adding these observations together, it is not a stretch that Microsoft might be considering acquiring an upstart like TikTok to help re-establish its position in the world of social networking.

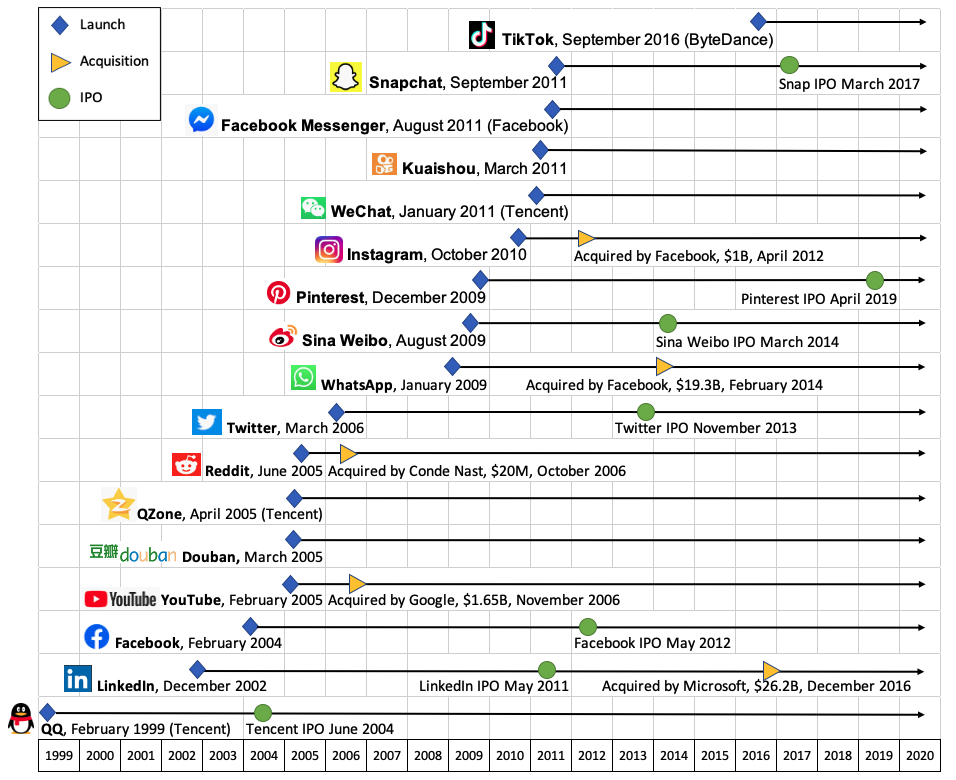

Social Networks, A short timeline

How does IP intersect?

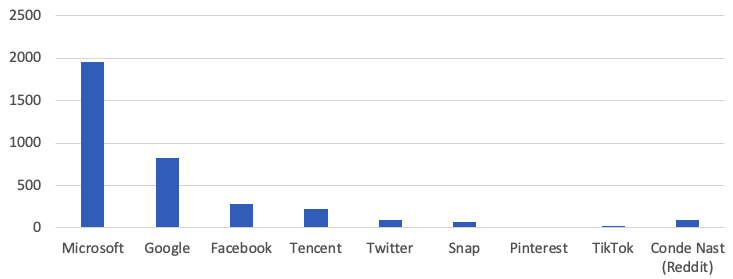

Microsoft has significantly more U.S. grants than ByteDance does (so do all of the established players like Google, Facebook, Tencent, Twitter, and Snap for that matter). It is no surprise that there are benefits associated with technological diversity and longevity within a field.

U.S. Grant Patents, Comparative (Microsoft = 42599, as of August 7, 2020)

Source: USPTO via ktMINE

Consider that multiple forms of IP are in play: Reddit parent Condé Nast is a global mass media company that uses copyright and trademarks for protection, as do the larger players with extensive scale.

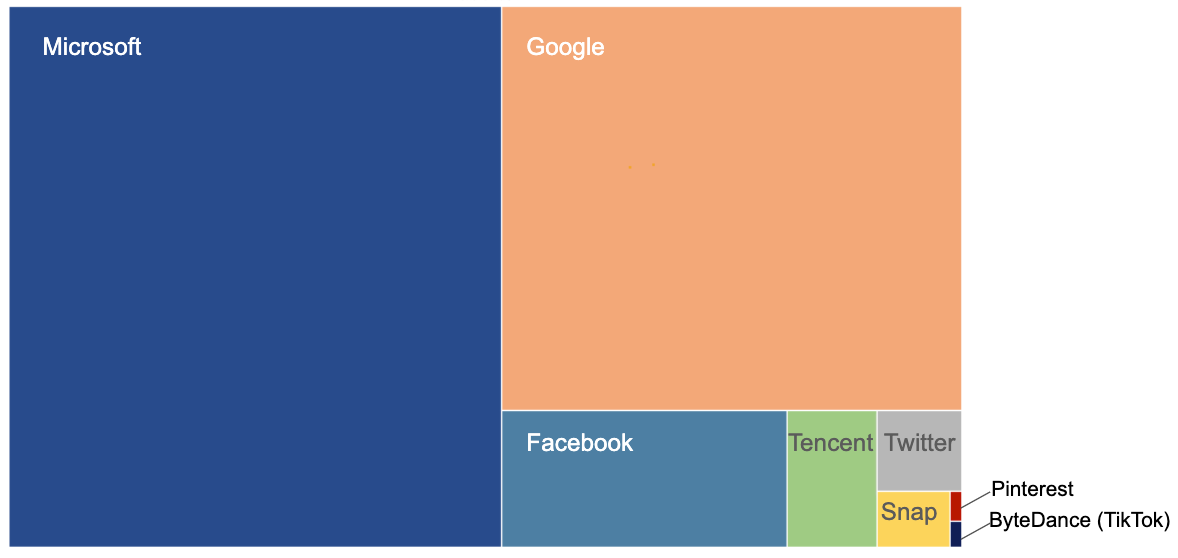

Registered U.S. Trademarks – Top Social Networks

Source: USPTO via ktMINE

Entities that are missing from these charts also provide insights: neither Kauishou, Sina Weibo, nor Douban have any U.S. grants or U.S. registered trademarks. This may be an indication that these players are either satisfied with the status quo or are unable to extend their reach into new markets. For these reasons, these entities may not be attractive candidates when addressing the challenges of the U.S. social network market.

ByteDance, at a comparatively early stage, is pursuing trademarks and patents to protect its explosive growth and this may be a strong attraction point for companies like Microsoft or others interested in acquiring.

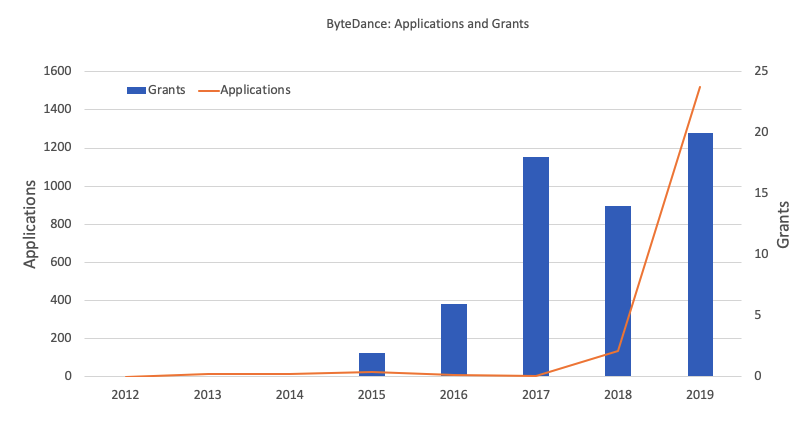

ByteDance Worldwide Grants and Applications

Source: USPTO via ktMINE

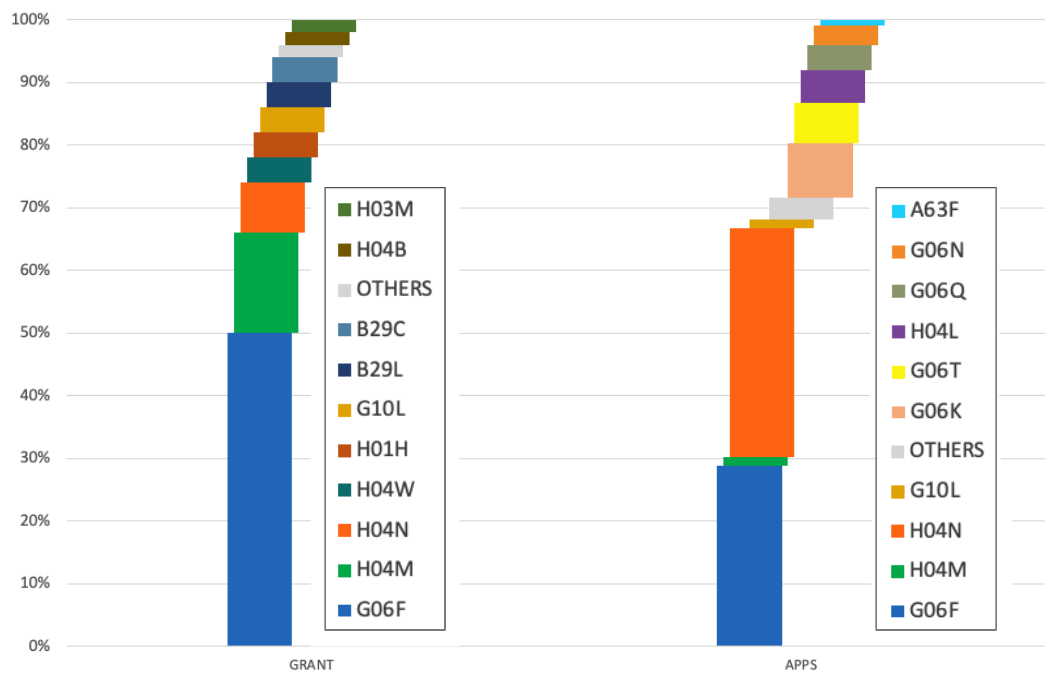

Taking a quick look at ByteDance’s technology areas, we see the classifications H03M, H04B, B29C, B29L, G10L, H01H, and H04W are no longer emphasized, whereas activity in G06K, G06T, H04L, G06Q, G06N, G10L, and A63L are either emerging or strengthening.

The shift of activity from one set of classifications to another is telling, and further analysis may provide deeper insights into specific innovations that might represent a hidden opportunity. In the interest of brevity, we won’t go deeper here, but the search for this opportunity would be aided in part by the small size of the ByteDance portfolio.

ByteDance Top Ten Classification Codes, By percent

Source: USPTO via ktMINE

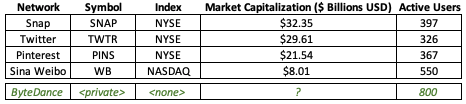

Price is another factor. It’s true that bargains can be found, like Google’s $1.65B acquisition of YouTube in 2006 or Facebook’s $1B acquisition of Instagram in 2012. More recently, however, such transactions have commanded a higher price tag. In 2014, Facebook invested $19.3B to acquire WhatsApp.

Market Capitalization of some Social Networks

Source: Yahoo Finance (as of August 10, 2020)

Microsoft paid over $26B for LinkedIn in 2016 and so they may be looking at TikTok as a low-cost option to boost its social networking presence.

Finally, there are tremendous geo-political ramifications that are likely to play out. We are happy to let the political scientists and diplomats work through this understated challenge. There you have it! A quick look at social networking and TikTok!