Taxpayers and practitioners should be looking for the existence of CUPs.

The CUP or CUT method remains a preferred method for any transfer pricing analysis. However, the very existence and subsequent availability of comparable documents has been considered a myth. At ktMINE, we know this is far from the truth. The OECD acknowledges their existence and availability within the most recent Guidance on Transfer Pricing Aspects of Intangibles, specifically Action 8 under OECD BEPS plan. [1] Learn More.

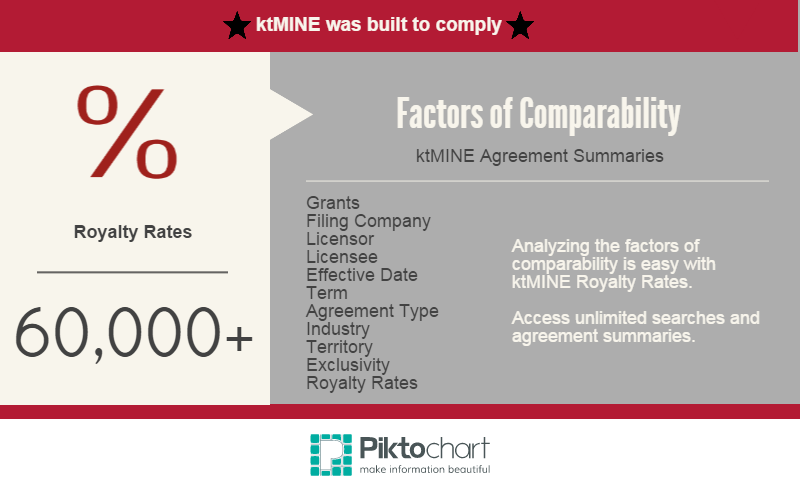

With ktMINE Royalty Rates, you have access to over 60,000 royalty rates sourced from the public domain. Additionally, every agreement is accompanied by a summary detailing the relevant factors of comparability, and the full text of the original document.

Contact us today for access.

[1] See Action 8 ¶¶s 6.134, 6.136, 6.143 and 6.145